What is Gusto Payroll? A Guide to Features, Pros and Cons, & Pricing

Efficient payroll processing is key to smooth business operations and achieving goals. Payroll software helps businesses manage these tasks easily, making work less stressful for employees. It’s reported that 49% of businesses now use payroll software, while 23% choose to outsource payroll services, highlighting its importance today. This software not only speeds up tasks but also makes them more enjoyable for everyone involved.

With many options available, from those catering to small startups to large companies, businesses can choose the right software to fit their needs. This review will focus on Gusto Payroll, a popular choice for improving payroll processes, exploring its features, pricing, and benefits for various business sizes.

What is Gusto Payroll?

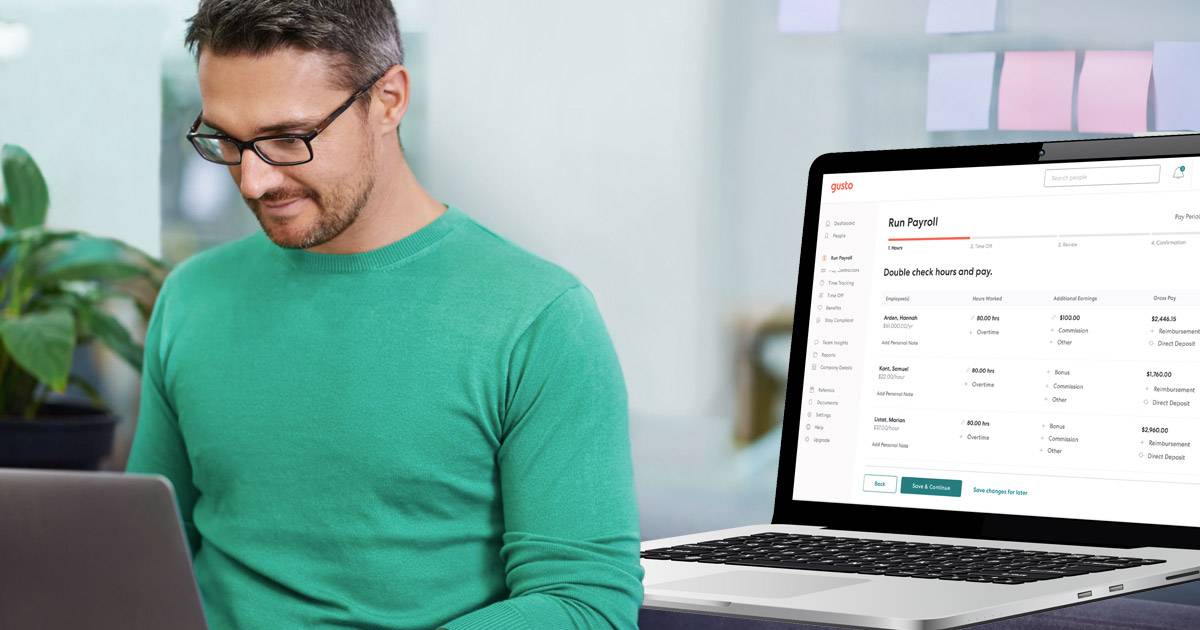

Gusto Payroll is an easy-to-use software designed for small and medium businesses to handle payroll and HR tasks. It helps automate payroll, manage taxes, onboard new employees, and offer benefits, making these processes smooth and stress-free. The software calculates and files taxes automatically, saving you time and reducing errors. For new hires, Gusto streamlines the onboarding process and manages benefits like health insurance.

Using Gusto is straightforward due to its simple interface, allowing you to set up and run payroll with ease. Security is a top priority, with the software using strong encryption and regular updates to protect your data.

Pricing Plans

1. Core Plan: $39/month + $6 per employee

Includes basic payroll services, two-day direct deposit, and a self-service portal for employees.

2. Complete Plan: $39/month + $12 per employee

Adds next-day deposit, PTO requests, employee directories, and project tracking to the Core features.

3. Concierge Plan: $149/month + $12 per employee

Offers everything in the Complete Plan along with dedicated HR support and access to resources for creating employee handbooks and job descriptions.

4. Contractor-Only Plan: $6/month per contractor

Ideal for businesses working with contractors, covering payments and tax form management.

These plans give businesses the flexibility to choose the right level of service for their needs.

Pros and Cons of Gusto Payroll

To get a clear picture of Gusto Payroll’s value, it’s important to look at both its benefits and drawbacks. This can help determine if it’s suitable for your business.

Pros

- Ease of Use: Gusto is designed to be straightforward, making payroll tasks simple even for beginners. This saves time and makes it easy for anyone to use.

- Automation: It automatically handles payroll calculations and tax filings, which reduces mistakes and lets you focus on other business areas.

- Integration Capabilities: Gusto works well with other software like QuickBooks, making it easy to transfer data between platforms and streamline operations.

- Strong HR Tools: The software offers great HR features, including onboarding processes, employee directories, and benefits management, which help manage your workforce more effectively.

- Employee Self-Service: Employees can log in to view their pay stubs, tax forms, and personal details, reducing administrative tasks for HR.

- Compliance Support: Gusto helps keep your business compliant with tax laws and regulations, offering peace of mind and reducing the risk of penalties.

Cons

- Higher Cost: Gusto might be pricier than some alternatives, especially for larger teams or businesses needing extensive HR functions.

- Limited Mobile App Functionality: The mobile app doesn’t offer all features available on the desktop, which might be inconvenient for those who need to manage payroll on the go.

- Customer Service Issues: Some users have experienced slow responses and challenges in getting help, which can be frustrating during urgent situations.

- Limited Customization Options: The software can be less flexible in terms of customization, which might not suit businesses needing specific features or workflows.

- Potential Learning Curve: New users might need some time to get fully comfortable with all of Gusto’s features, especially if they’re used to a different system.

You can make a more informed decision about whether Gusto Payroll suits your needs and budget by weighing these benefits and drawbacks.

Best Business Types and Sizes for Gusto Payroll

Gusto Payroll is great for different business types and sizes. Here’s how it fits for each:

Small Businesses

For small businesses, the Core Plan is a perfect match. It includes basic payroll services, a self-serve option for employees, and two-day direct deposit. This plan is budget-friendly and simple, making it easy for small business owners to handle payroll without added complexity.

Startups

Startups, which often need more flexible options as they grow, should consider the Complete Plan. This plan offers features like next-day direct deposit, tracking for time off, and employee directories. These tools help startups keep up with rapid changes and manage their growing teams effectively.

Medium-Sized Companies

For medium-sized companies, the Concierge Plan is ideal. It includes everything in the Complete Plan, plus extra HR support to help with employee handbooks and job descriptions. This plan is designed to meet the more advanced HR needs of medium-sized businesses, offering expert help to manage larger teams.

Is Gusto Payroll Worth It?

When considering if Gusto Payroll is worth it, user reviews provide a clear answer. Many users highlight its user-friendly interface, which makes managing payroll straightforward, even for those who aren’t tech experts. This ease of use is a big plus for busy business owners. Additionally, Gusto’s customer support receives high marks for being responsive and helpful, quickly resolving any issues that arise.

Gusto also boasts a comprehensive set of features that cover payroll, benefits, and HR tasks in one platform. This all-in-one solution helps businesses run smoothly and manage their teams effectively. Users often mention that Gusto enhances business efficiency by saving time and reducing errors, allowing more focus on growth.

All these factors point to Gusto Payroll being a worthwhile choice for businesses. Its simplicity, strong support, and extensive capabilities make it a smart investment for those looking to improve efficiency and reliability in their payroll and HR operations.