A Review of PayPal Business Loans: Is it Worth it for Businesses?

Quick Verdict

PayPal offers accessible financing options through its Business Loan and Working Capital products, making it easier for entrepreneurs to secure quick funding. With lenient qualification criteria and fast funding speeds, these loans can be ideal for businesses needing immediate cash flow support.

PayPal provides two main financing options: the PayPal Business Loan and PayPal Working Capital, both designed to help business owners who use PayPal for payment processing. While these loans can be beneficial for quick cash flow needs, entrepreneurs should understand their distinct features before deciding which loan option is best for their business.

What is PayPal Working Capital?

PayPal Working Capital is designed for businesses that have been using PayPal for at least three months and have a minimum of $15,000 in annual sales. This loan option allows businesses to borrow money based on their future PayPal sales. It’s particularly useful for those with variable cash flows, as repayments are tied directly to sales, making it more manageable during slow periods.

Key Features of PayPal Working Capital

- Flexible Repayment Structure: Payments are based on a percentage of your daily sales. This means that during slow sales periods, repayment amounts decrease, providing a safety net for businesses.

- Quick Funding: Loan approvals can happen within minutes, with funds often available the same day.

- No Credit Check Required: Unlike traditional loans, PayPal does not consider your credit score for Working Capital loans, making it accessible for businesses with poor credit histories.

PayPal Business Loan: A Closer Look

The PayPal Business Loan differs in structure and requirements. This option is more suited for established businesses that require a larger loan amount and have a more stable revenue stream.

Key Features of PayPal Business Loans

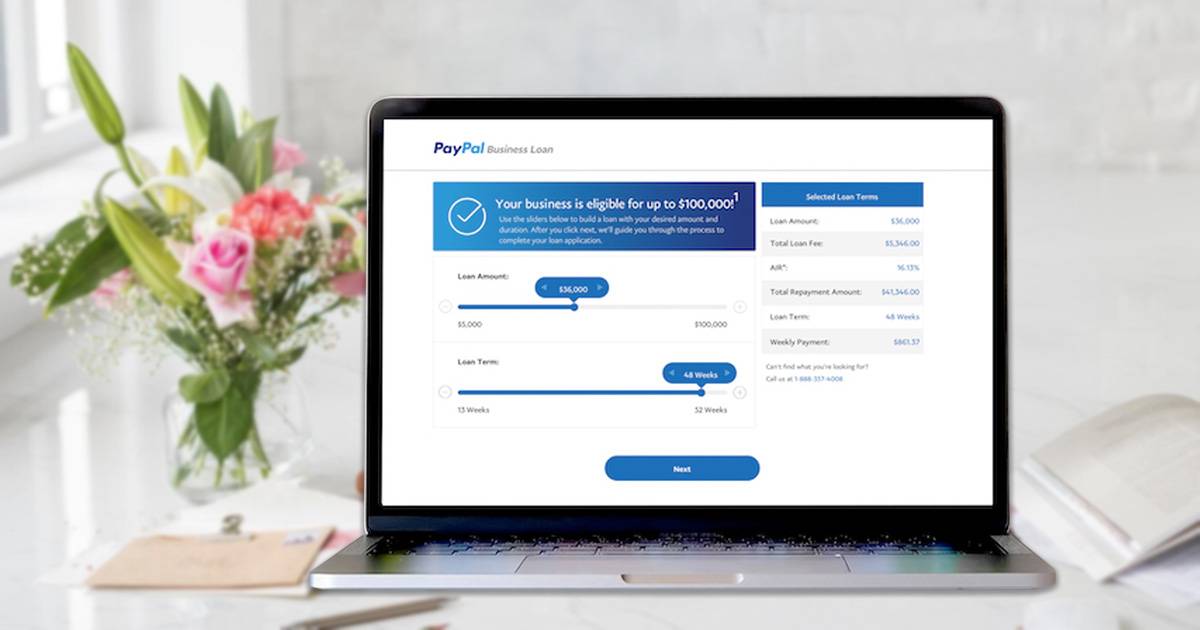

- Higher Loan Amounts: Business loans range from $5,000 to $150,000, which can be advantageous for larger projects or expansions.

- Fixed Repayment Schedule: This loan requires weekly repayments directly from your bank account, offering less flexibility compared to the Working Capital option.

- Minimum Revenue Requirements: To qualify, businesses need to demonstrate an annual revenue of at least $33,300 and have been operating for a minimum of nine months.

Pros and Cons of PayPal Business Loans

Before applying for a PayPal Business Loan, it’s essential to weigh the advantages and disadvantages to ensure it aligns with your business goals.

Advantages of PayPal Business Loans

- Accessibility: Both PayPal Working Capital and the PayPal Business Loan have lower revenue requirements compared to traditional bank loans, making them accessible to a broader range of businesses.

- Fast Approval and Funding: Entrepreneurs can receive funds quickly, which is crucial for urgent financial needs.

- No Collateral Required: Neither loan requires collateral, reducing the risk for business owners.

Disadvantages of PayPal Business Loans

- High Fees: Instead of traditional interest rates, PayPal charges a fixed fee that varies based on the loan amount and repayment percentage. This can sometimes lead to confusion when compared with other lenders.

- Weekly Repayment for Business Loans: The weekly repayment structure may strain cash flow for some businesses, especially during leaner periods.

- Not Ideal for Long-Term Financing: These loans are generally designed for short-term financial needs rather than long-term investments.

Eligibility Requirements

Understanding the eligibility criteria is vital for entrepreneurs considering these financing options.

PayPal Working Capital Requirements

- PayPal Account: Must have an active PayPal Premier or Business account for at least 90 days.

- Sales History: At least $15,000 in annual sales for Business accounts or $20,000 for Premier accounts.

PayPal Business Loan Requirements

- Credit Score: A minimum FICO score of 580 is required.

- Operating History: Must have been in business for at least nine months.

- Annual Revenue: A minimum annual revenue of $33,300 is required.

Application Process

The application process for both loans is relatively straightforward.

Applying for PayPal Working Capital

- Log into Your PayPal Account: Start the application process by logging into your PayPal account.

- Fill Out the Questionnaire: Complete a brief questionnaire to assess your business’s eligibility.

- Review Loan Offers: If eligible, PayPal will present you with loan options, including the loan amount and fee structure.

Applying for a PayPal Business Loan

- Business Information: Provide your business details, including revenue and operating history.

- Credit Check: PayPal will conduct a soft credit check to determine eligibility.

- Funding Timeline: Upon approval, funds can appear in your account by the next business day.

Comparing PayPal Working Capital and PayPal Business Loan

To determine which financing option best suits your needs, consider the following key features:

- Loan Amount: PayPal Working Capital offers loans ranging from $1,000 to $200,000, while the PayPal Business Loan provides amounts between $5,000 and $150,000.

- Repayment Structure: With PayPal Working Capital, repayments are based on a percentage of your daily sales. In contrast, the PayPal Business Loan requires fixed weekly payments.

- Funding Speed: PayPal Working Capital loans can be funded within minutes, whereas PayPal Business Loan funds are available the next business day.

- Credit Score Requirement: The PayPal Working Capital does not consider your credit score, while the PayPal Business Loan has a minimum requirement of 580.

- Revenue Requirement: For PayPal Working Capital, you need to show annual sales between $15,000 and $20,000, while the PayPal Business Loan requires a minimum annual revenue of $33,300.

Alternatives to PayPal Loans

While PayPal provides convenient financing options, exploring other alternatives can help you find the best fit for your business needs. Consider these alternatives:

- Online Business Loans: Numerous online lenders provide flexible funding solutions, offering competitive interest rates along with a range of repayment options. Platforms like Kabbage and OnDeck can provide loans based on your business performance and needs.

- Traditional Bank Loans: For businesses looking for larger sums and lower interest rates, traditional bank loans may be a better fit. However, they often have stricter requirements and a longer application process.

- SBA Loans: SBA loans offer attractive terms for small businesses, though they typically involve longer processing times and require more extensive documentation. They are worth considering for those seeking longer-term financing.

The Final Verdict: Is a PayPal Business Loan Right for You?

Determining whether a PayPal Business Loan or Working Capital option is suitable depends on your unique business needs and financial situation.

- If you operate a newer or smaller business with fluctuating sales, PayPal Working Capital may offer the flexibility you need. The quick funding and sales-based repayment structure can be particularly helpful during slower months.

- On the other hand, if your business has consistent revenue and needs a larger sum for expansion or urgent expenses, the PayPal Business Loan may be the better option, provided you can manage the weekly repayments.

Ultimately, carefully reviewing both options, comparing fees, and assessing your business’s financial health will help you make an informed decision.